Spinal surgery demands exceptional precision to ensure patient safety and successful outcomes. Traditional imaging techniques can expose patients and surgeons to high levels of radiation. Optical Navigation technology offers a breakthrough by enhancing accuracy while significantly reducing radiation exposure.

Optical Navigation is redefining precision in spinal surgery. With the integration of cutting-edge imaging and real-time guidance, surgeons now have the power to operate with enhanced accuracy while significantly reducing radiation exposure. Whether you’re a spine specialist or a healthcare provider aiming for better outcomes, Optical Navigation offers a smarter, safer path to surgical success.

What is Optical Navigation in Surgery?

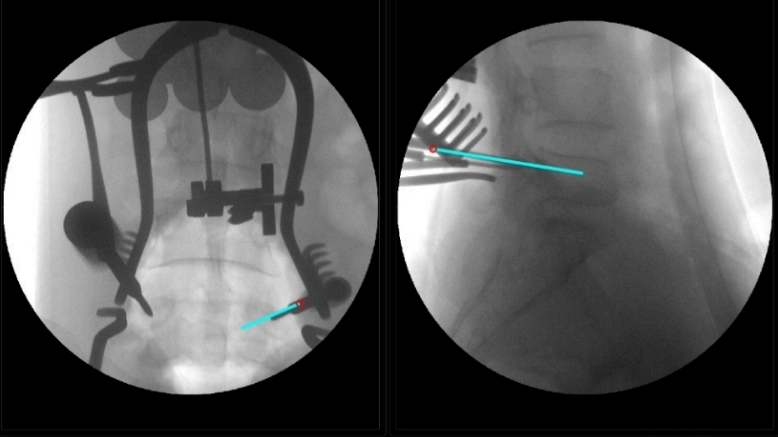

Optical Navigation is a computer-assisted surgical guidance system that employs infrared cameras and reflective markers to track surgical instruments in three-dimensional space. This technology integrates with two-dimensional and three-dimensional imaging acquired before and during surgery, providing continuous and precise guidance throughout spinal procedures where accuracy is critical.

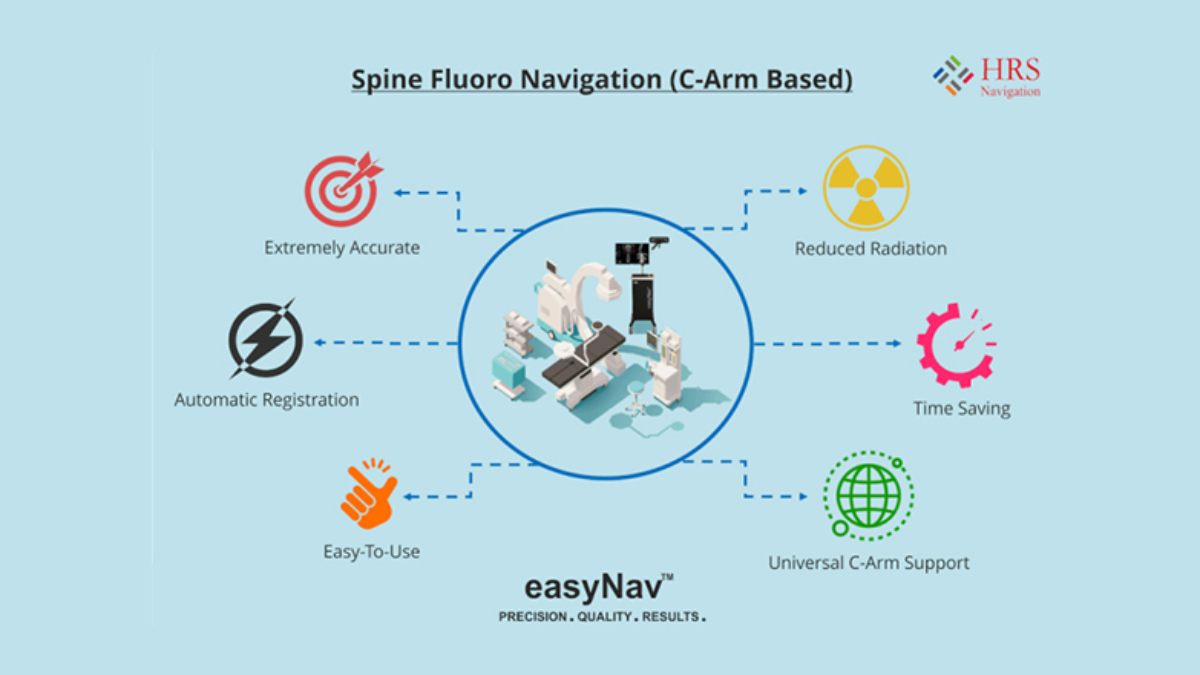

Building on the core principles of optical navigation, the easyNav system brings these advanced capabilities directly into the operating room, ensuring precise guidance for spinal surgeries across various clinical settings.

How easyNav Enhances Surgical Precision

The easyNav system is designed to bring the benefits of optical navigation into everyday clinical practice. It is compatible with all types of C-arm imaging machines, from conventional models to the latest flat-panel systems, ensuring reliable navigation in diverse operating rooms.

Key features include:

- Real-time instrument tracking using pre-acquired imaging data

- Automatic registration of anatomical structures for seamless workflow

- Support for both open and minimally invasive spinal surgeries

Reduced Radiation Exposure with Optical Navigation

One of the main advantages of optical navigation is the significant reduction in radiation exposure for both patients and surgical staff. easyNav minimises the number of intra-operative C-arm images required by providing real-time guidance based on existing two-dimensional and three-dimensional datasets. Additionally, it enables multi-planar imaging without frequent repositioning of the C-arm, lowering overall radiation doses.

Improved Accuracy and Workflow Efficiency

With easyNav, surgeons can achieve highly accurate placement of pedicle screws and other instruments. The system reduces anatomical shift errors and minimises delays caused by repeated imaging. This leads to a smoother, more efficient surgical workflow and improved patient outcomes.

System Compatibility Across All C-arm Models

The easyNav system is engineered to work with a wide range of C-arm machines, including:

- Flat panel C-arms

- Conventional fluoroscopy machines

- The latest generation of surgical imaging systems

This versatility makes easyNav a future-proof solution that is adaptable to any spinal surgery setup.

Why Should You Consider easyNav for C-arm Integration?

easyNav is a cutting-edge navigation system tailored specifically for spinal surgeries, capable of integrating seamlessly with all types of C-arm machines, whether conventional or advanced. Here are some key benefits:

Reduced Radiation Exposure

- Minimises the number of C-arm shots needed

- Offers real-time guidance using pre-acquired two-dimensional and three-dimensional images

- Real-time C-arm navigation reduces radiation exposure

Increased Accuracy

- Automatic registration of anatomical structures

- Accurate pedicle screw placement with real-time visualisation

- Enhanced accuracy through spine marker and registration technology

Supports Minimally Invasive Spine Surgery

- Enables smaller incisions and optimised trajectories

- Provides real-time navigation with compatible surgical instruments

Efficient Surgical Workflow

- Reduces anatomical shift errors

- Minimises intra-operative imaging time

- Decreases the need for constant C-arm repositioning

Superior Ergonomics

- Greater C-arm mobility compared to conventional fluoroscopy

- Facilitates multi-planar imaging without workflow disruption

Custom Spine Tracker Attachments

- Compatible with drills, screwdrivers, and other tools

- Enhances calibration and navigation accuracy

The prime factor of easyNav Spine Navigation comes from the capacity to be integrated with any version of C-arm ranging from flat panel or conventional C-arms to the latest versions.

The Growth of the Indian Healthcare Industry and Optical Navigation

India’s healthcare sector is among the fastest-growing and most dynamic industries, contributing nearly 60 percent of total industry revenue. It spans hospitals and clinics, medical devices and equipment, telemedicine and clinical trials, health insurance, medical tourism, and alternative medicines such as Ayurveda and Homeopathy.

Historical Growth and Challenges

From the 1950s to the early 2000s, India experienced steady expansion of public and private healthcare facilities. However, rapid population growth led to a doctor-patient imbalance. Advances in infrastructure and the private sector have significantly bridged this gap by 2010.

Emerging Trends Driving Growth

- Digitalisation and artificial intelligence in healthcare, including electronic health records for better data access and AI-powered diagnostics and robotic surgeries

- Teleconsultation and remote patient care services

- Medical tourism offering high-quality care at 15 to 20 percent of the cost compared to Western countries, with skilled healthcare professionals

- Healthcare innovations such as minimally invasive treatments, personalised medicine based on genetic profiles, world-class implants, and robotic procedures

Future Outlook: Vision 2030

By 2030, India’s healthcare industry is projected to be worth ₹6.2 trillion, offering precise and minimally invasive treatments while heavily leveraging artificial intelligence, robotics, and digital platforms. The sector will restructure its workforce, pharmaceuticals, and medical devices to meet modern care delivery standards.

Impact of COVID-19

While patient visits temporarily declined during lockdowns, India’s effective surveillance and proactive measures helped manage the outbreak. The country’s strong manufacturing base for vaccines and generic medicines supports a swift healthcare recovery.

Final Thoughts

Optical Navigation is truly transforming spinal surgery by combining precision, safety, and efficiency. The easyNav system exemplifies how advanced technology can reduce radiation exposure, enhance surgical accuracy, and streamline workflow without compromising patient outcomes. Its compatibility with a wide range of C-arm machines and support for minimally invasive techniques make it a versatile solution for modern operating rooms.For surgeons and healthcare providers looking to elevate their spinal procedures, investing in a reliable and cutting-edge spine navigation system like easyNav can make all the difference. Embracing such innovations not only improves surgical success but also paves the way for safer, more patient-centric care in the future.

Frequently Asked Questions

What is Optical Navigation?

Optical Navigation is a surgical guidance technology that uses infrared cameras and reflective markers to track the position of surgical instruments in three-dimensional space, providing real-time navigation during surgery.

What is Optical Flow for Navigation?

Optical flow is the pattern of apparent motion of objects or surfaces in a visual scene caused by the relative movement between the observer and the scene. In surgical navigation, optical flow algorithms interpret real-time imaging to guide instruments accurately.

How does Optical Navigation reduce radiation exposure?

Optical Navigation reduces radiation by providing continuous real-time guidance based on pre-acquired imaging, which decreases the need for repeated intra-operative X-rays, lowering radiation doses for both patients and surgical teams.